This means that they must provide sensibly by the correctly evaluating your finances plus power to pay back any loans otherwise credit it commit to render

- Has a top rate of interest and you will associated fees compared to the basic lenders

- Always need a higher put

- Always need you to take out financial insurance rates in case the financing worth proportion (LVR) is actually more than sixty%. Mortgage mortgage insurance policies helps include the financial institution while unable while making your future money.

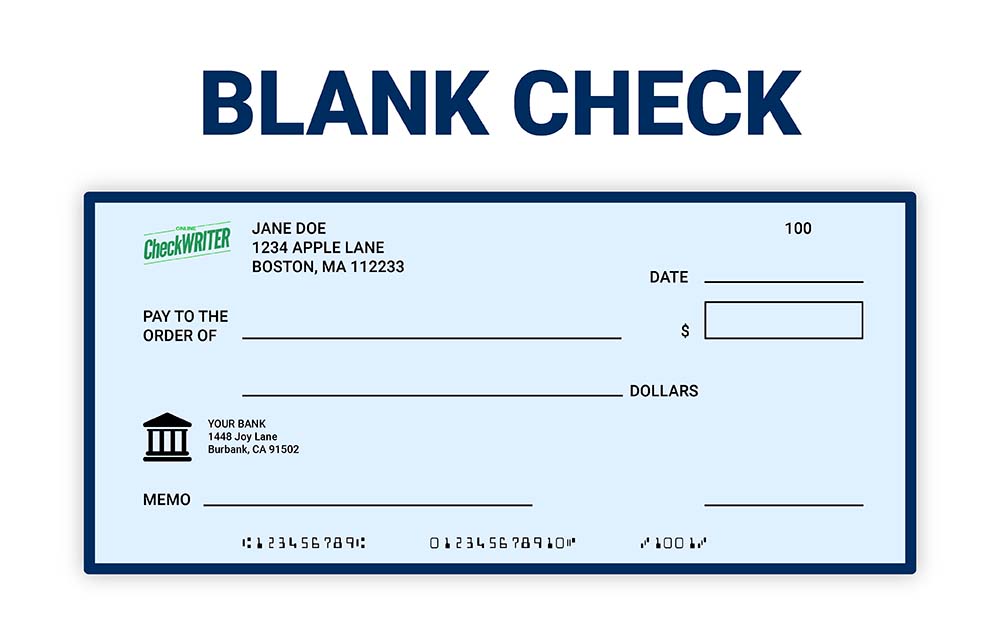

To possess a low doc financial, you could potentially provide things for example:

As well, it may be much harder for you refinance their reduced doctor mortgage later if the items alter, compared to a fundamental financial.

Low doctor fund allows you to play with different choice a way to show your income. Calculating the probably income in the event it varies is obviously an incredibly very important element of the review.

Consequently they need to provide responsibly of the accurately evaluating your own financial predicament along with your capacity to pay back any loans or borrowing it invest in promote

- A finalized declaration saying cashadvancecompass.com/loans/personal-loan-rates your income. It is important this declaration is actually specific and you will practical to suit your age and you can profession, provided all of the most recent and coming possible situations of one’s business.

- Company Craft (BAS) Comments for the past 6 or one year or higher (preferably showing expanding turnover/revenue/profits). Of several individuals have a tendency to restrict your limitation LVR without this type of statements.

- Your online business and private tax statements.

- Your online business lender comments. Essentially this would have shown the conventional and you will confident income off your organization.

- A keen accountant’s page confirming your income says.

- The newest economic statements for your needs (ideally served by an accountant). Including, profit-and-loss statements and you may an equilibrium layer proving their businesses assets and you will obligations.

More ones you could bring that demonstrate proof of highest turnover (and money) for your business, the greater. Lenders have a tendency to glance at self-functioning people since the a higher exposure as they are a great deal more conservative in their lending practices together.

Certain care about-employed people are asset-steeped but dollars poor. Loan providers should come across proof of their normal, positive income are certain that you will be able meet up with your loan payments. Also, it is good for them to discover proof assets that your company has generated up over time. They implies that youre reinvesting on your business hence you want for this becoming available for a long time. A principle is the fact your organization property will be comparable to twice your company earnings, though this can are very different of the variety of company.

If you are care about-operating, you have a keen Australian Providers Count (ABN) and can most likely feel entered for GST. In australia, it is mandatory for businesses that have a yearly revenues (we.e. turnover) in excess of $75,000 to register for GST. Really loan providers would want to select research your company is a feasible lingering concern by having your ABN, GST registration and relevant monetary comments getting a time period of several decades or higher.

Not all lenders offer reduced doc loans and people you to possess some other lending criteria. Instance, they will provides various other minimum records conditions and other limitation LVRs. Their attention pricing and you can related costs will additionally vary appropriately.

As a whole, despite a low doctor mortgage you ought to offer since far confirmed suggestions as you can to increase your odds of recognition. you have to make sure that the pointers your supply was well-displayed, perfect and you may fully supporting what you can do to help make the financing payments. We could allow you to accomplish that.

The spot of the home you want to buy may also feel a button planning for the bank. A house within the a desirable location is not as large a risk to the bank, as they will get understand you to feel a high chance just like the a reduced doctor mortgage applicant. Well-managed house when you look at the funding places will tend to be viewed even more favorably by lenders than those much more separated, regional locations that may be more challenging so that they can offer if you were to standard on your mortgage repayments.

Under Australian consumer credit shelter laws, loan providers is legally bound in order to conform to responsible financing specifications. Inability so you can follow men and women arrangements carries high charges.

MOST COMMENTED

Tin Tức

Spielautomat Egypt 100 Kostenlose Spins Keine Einzahlung Dracula Sky Für nüsse Referieren فلاتر مياه تانك

kuinka ostaa postimyynti morsiamen

dos Create worth to each and every pursue-upwards current email address

Tin Tức

30 Freispiele abzüglich Einzahlung: Für nüsse Casino Free Spins

Tin Tức

Willkommen inside SlotsMagic 50 Free Spins ohne Einzahlung pro Neukunden

Tin Tức

Have the casino maneki free spins Exclusivity away from Spin Castle Gambling enterprise: Unleash 100 percent free Spins, Enjoyable Bonuses, and Greatest-notch Gambling games!

Tin Tức

Siberian Violent storm Twin thunderstruck slot login bonus codes Play Harbors, Real money Slot machine and Totally free Enjoy Trial

Tin Tức

Spiele Black Beauty kostenlos within Merkur24