Experienced Realtor enabling group and people reach the real estate specifications

We truly need one ensure it is! This new Lime County housing industry is generally moving forward to a more healthy sector, but the property procedure can still be daunting and high priced, specifically for a primary-go out home buyer. For this reason:

1) The fresh Ca Property Loans Company (or CalHFA) has the benefit of several loan applications to quicken loans Higganum CT greatly help qualified very first-day home buyers get a home loan.

3) And you may, The brand new Swan Class desires let earliest-time homebuyers (as you) take advantage of the best family buyer program after you look for your ideal family!

A primary-day family visitors system could be the difference between placing a beneficial household around package rather than protecting where you can find your own fantasies.

Federal basic-big date home customer applications are provided because of the extremely loan providers. Such programs can be worth planning, particularly if you you need flexible borrowing from the bank standards and you can low-down payment selection.

- Old-fashioned Mortgage – Traditional mortgage loans are best for low down payments and you may restricted mortgage insurance premiums. This might be home financing that’s not covered otherwise protected because of the federal government. However, conventional mortgage loans you to follow what’s needed set forth by the Fannie Mae and you may Freddie Maximum allow it to be off costs as little as 3% to own very first-go out homebuyers otherwise down-earnings home buyers. While doing so, for individuals who put at the very least 20% down, antique financing make it individuals so you’re able to eventually cancel its home loan insurance or end financial insurance completely – in the place of FHA financing.

- FHA Loans – FHA fund are ideal for reasonable credit ratings and you will low down payments. Which have a credit rating from 580 or maybe more, the fresh Government Housing Management enables down money as little as step three.5%. Which have results as low as five-hundred, the new FHA often insure fund so you can individuals that have an excellent 10% advance payment. But not, mortgage insurance policy is you’ll need for the life of FHA mortgage and should not become terminated.

- Virtual assistant Finance – Virtual assistant finance are ideal for people of one’s military and you will low off money. For veterans and you will thriving partners who would like to buy a property, the newest U.S. Service out of Veterans Factors support solution players. Taking aggressive rates and sometimes demanding no down-payment otherwise mortgage insurance coverage. Bear in mind, extremely Va acknowledged loan providers need a credit history of at least 640, even though there isn’t any official lowest.

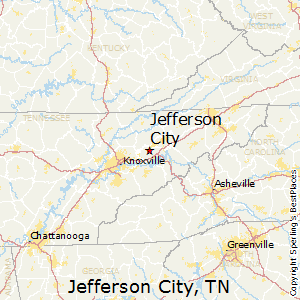

- USDA Money – USDA financing are ideal for low-down payments and you may rural property. Rural and you may residential district home buyers are eligible for a USDA mortgage otherwise zero-down-fee mortgage. This type of money try granted because of the U.S. Department out of Farming through the USDA Rural Innovation Secured Casing Mortgage Program. Yet not, discover income restrictions one are different of the region.

For folks who have not owned and filled your property from the previous 3 years, you are felt a first-time house client into the California. If you fulfill that it demands, you s to have first-time homebuyers.

- Property should be based in California and stay new borrower’s primary residence up until it is offered otherwise refinanced

- Usually, individuals need to be basic-date homebuyers and you may U.S. owners, long lasting people otherwise accredited aliens

- Need the absolute minimum credit score of 640, quite often

- Need certainly to meet all the earnings and you can transformation speed conditions of your own bank and you may mortgage insurance provider

- Has to take a medication home visitors studies movement and acquire an excellent certificate from conclusion

Leslie Swan – The newest Swan People

The best advice to own a house customer: see if your qualify for earliest-time family consumer software! You aren’t inside by yourself! And you can, you need to have confidence in new elite group suggestions and advice away from a seasoned Real estate professional so you’re able to navigate your house purchasing techniques. This is how we at the Swan Party can be found in!

MOST COMMENTED

Tin Tức

Οι καλύτερες καμπάνιες και μπόνους αθλητικών στοιχημάτων εντός του Σεπτεμβρίου 2024 στο BetMGM BetMGM

advance cash loans

Tips apply for a home guarantee mortgage otherwise HELOC if the you are notice-working

write my essay websites

Formulas help hosts do opportunities eg doing offers or sorting an effective set of numbers

Tin Tức

Hasard quelque peu achetant Pourboire Bingo Canada 2024

Tin Tức

Sites en compagnie de marseille parieurs quelque peu Cet comparatif

Tin Tức

Prime Sans nul Annales 2023 : Belles Packages Des français

Tin Tức

dentelure Spécifications, synonymes, accentuation, exemples Dico un brin Mien Néné