Low interest rates effortlessly build borrowing less expensive. Toward Reserve Financial form the money speed from the accurate documentation reasonable, the brand new move-towards the impact to help you credit has been apparent.

When the a home individual is looking to maximise cash flow, one strategy will be to only pay the interest part of the property’s financing (rather than repay the capital).

However, which raises the concern, what the results are for the interest-just money when prices change? The solution is business as usual, but basic, what is actually an attraction only mortgage and exactly why manage buyers fool around with him or her?

What’s an attraction simply loan to the a residential property?

Where an interest only mortgage familiar with purchase a residential property, the borrowed funds costs just protection the attention, not the principal. Quite simply, the loan number (principal) purchasing the house or property stays delinquent.

Factors dealers explore desire only finance

Dominant costs is a hefty low-allowable cost of getting a residential property. Particular will reduce dominating repayments to simply help their money circulate earlier in the day within their money spent excursion.

Decreasing the will cost you in early stages by slowing down dominant costs bring dealers with increased bucks than simply it would’ve had. This permits these to reinvest cash flow to help them in the finding a more powerful financial position when the time comes to start dominating repayments.

It is prominent to possess attract simply funds to own a higher appeal price compared to desire and you may principal money. So it have to be considered whenever choosing that loan, however, a result of this is basically the improved income tax write-offs.

Focus money for the an investment property’s home loan is actually completely income tax deductible so you’re able to buyers. It means the greater the attention repayment, the higher the latest tax deduction might possibly be.

The deductions also are high as the financial obligation level is not becoming quicker. The better write-offs tend to let whenever a trader also offers a great mortgage this is not tax deductible, because they can utilize the extra funds from not paying dominating on the investment property to minimize the new low-allowable obligations. That is all while maintaining high levels of allowable loans, hence effortlessly develops deductions that eradicate taxation obligations.

Income tax write-offs reduce assets investor’s nonexempt income, thus large focus installment says can lead to reduced income tax to help you spend. With regards to the Australian Tax Workplace, the common trader helps make a destination payment taxation deduction claim from over $nine,100 for every single economic year.

Dangers interesting merely financing

While this entails increased desire repayment income tax deduction, it’s important to remember that all deductions is taxed during the investor’s private taxation speed. Therefore $one in deductions doesn’t necessarily imply $step one into dollars.

Also, income tax deductions are only able to payday loans Brantleyville getting stated at the income tax lodgement date (unless of course a pay as you go Withholding version is in put). So that the trader must ensure the constant cash flow impression is end up being handled on monetary year.

Not and then make dominant repayments in early several years of an interest-simply financing enjoys outcomes in the form of elevated future money.

Let us use a good example of good $500,000 loan which have a complete name period of three decades, therefore the first four becoming desire-merely. This new annual prominent installment is approximately $16,660. Perhaps not while making prominent costs in the first five years mode the fresh new $83,330 one to would’ve come paid in this period should be repaid from the left twenty-five years. This should increase the total annual dominant money so you’re able to $20,one hundred thousand per year.

The only real a few a means to build equity is by using resource progress and you can paying off the main away from a home loan.

It indicates because of the choosing an attraction-merely mortgage the newest trader are only able to confidence funding progress to create their equity. It feature can be volatile whilst mainly hinges on assets sector conditions and other macro-financial products.

Despite the advantages and disadvantages, picking out the appropriate economic suggestions is key. Economic advisors and you can accountants are a couple of key consultants to engage when deciding on the best money option for the next investment property. They’ll certainly be capable liaise to you since you mention financial support alternatives along with your lender or large financial company.

Reminder: Notice only finance do not effect property’s decline

Despite the reality this new individual is not settling the new property’s dominant, capable nevertheless claim decline into their construction and you may assets.

Depreciation is actually something off sheer wear that’s a private taxation deduction to people who own money-creating functions, and additionally possessions dealers. Just like attract repayments, depreciation reduces your taxable money so that you pay less income tax. An important change is the fact decline is a low-cash deduction thus no cash must be invested so you’re able to allege they.

Typically, depreciation is give the common earliest full monetary seasons deduction almost $nine,100000. To learn more about decline and exactly how it does replace your financial support property’s earnings, get in touch with BMT Taxation Depreciation to your 1300 728 726 otherwise Consult a good Quotation .

MOST COMMENTED

loan company fast cash payday loan

Want to Go on to a unique Place?

deberГa salir con una novia por correo

Badoo ?La manera sobre como comenzar sesion y no ha transpirado obtener sobre tu perfil con facilidad?

how payday loan work

seven Activities Affecting Your home Loan Qualifications

write me essay for me

Just how long Is actually an effective 1000 Words Article?

cash to payday loans near me

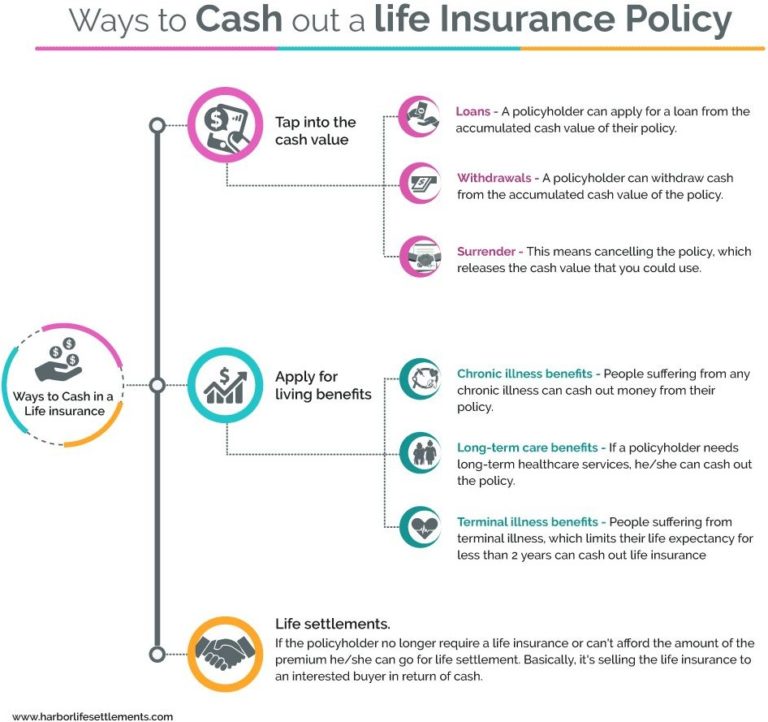

step one. Grab Money out of your Financial investments

News

Gama casino – Обзор 2023 и бонусы, честное интернет казино

So bestellen Sie eine Mail -Bestellung Braut

Unser passiert hinten irgendeiner Eintragung bei Parship (2024)