The fresh new U.S. Agency of Farming (USDA) is declaring this new release of the newest Upset Consumers Advice System, an effort made to render customized help to help you financially distressed growers and you will ranchers across the nation. Courtesy several Cooperative Agreements, it national circle tend to link disappointed individuals having personalized assistance to enable them to balance out and win back monetary ground. USDA’s Farm Solution Agencies (FSA) produced that it statement Tuesday in the Farm Support Event during the Saratoga Springs, Ny.

We already been my out-of-farm field since a ranch Recommend, doing work give-in-hands along with other tireless farmer supporters. Having anybody which have knowledge into the ag loans let manufacturers function with financial hardships could be the difference between them shedding the brand new farm otherwise prospering, told you FSA Administrator Zach Ducheneaux. This new Disturb Borrowers Guidance Community underscores the commitment to farmers and you may ranchers finding brand new designed assistance they need. Such partnerships along with show one to USDA understands the necessity of such advocates and you can notices them as part of the choice to be sure system availableness for everyone growers, ranchers, and you can manufacturers.

Circle lovers were Ranch Support, Rural Development payday loans Horn Hill Basis Globally, the College from Arkansas, brand new Socially Disadvantaged Farmers and you may Ranchers Rules Center in the Alcorn County School, and also the College or university out of Minnesota. By this initiative, we’re working together that have community-oriented communities to raised suffice economically upset companies.

FSA, together with farm assistance organizations and you can house-offer establishments, will support it system, that provide the technical info and you can information out-of USDA partners in order to benefits away from disturb and you will underserved organizations. The fresh new network’s means comes with partnering experienced companies to deliver that-on-you to help to help you consumers for them to top generate preparations and you will know options to defeat its monetary pressures.

New Distressed Individuals Advice Community will target this new instantaneous need off troubled individuals and provide comprehensive, wraparound functions intended for handling exclusive pressures faced from the economically upset producers. Immediately following stabilized economically, such borrowers might be greatest positioned to get into the fresh options and remain contributing to the new agricultural discount. Such assets also generate a system away from companies that is most readily useful help agricultural groups for years to come. Investing a system away from farming financial support service providers to aid bridge access to FSA financing is an advantage getting rural and you will agricultural organizations.

FSA recently established significant change to Ranch Mortgage Apps through the Increasing System Availability and Delivery to possess Ranch Finance signal. Such plan alter, for taking effect Wednesday, Sept. twenty five, are made to develop options to possess borrowers to improve profitability and you may be better prepared to generate strategic investment in the improving or broadening the agricultural functions.

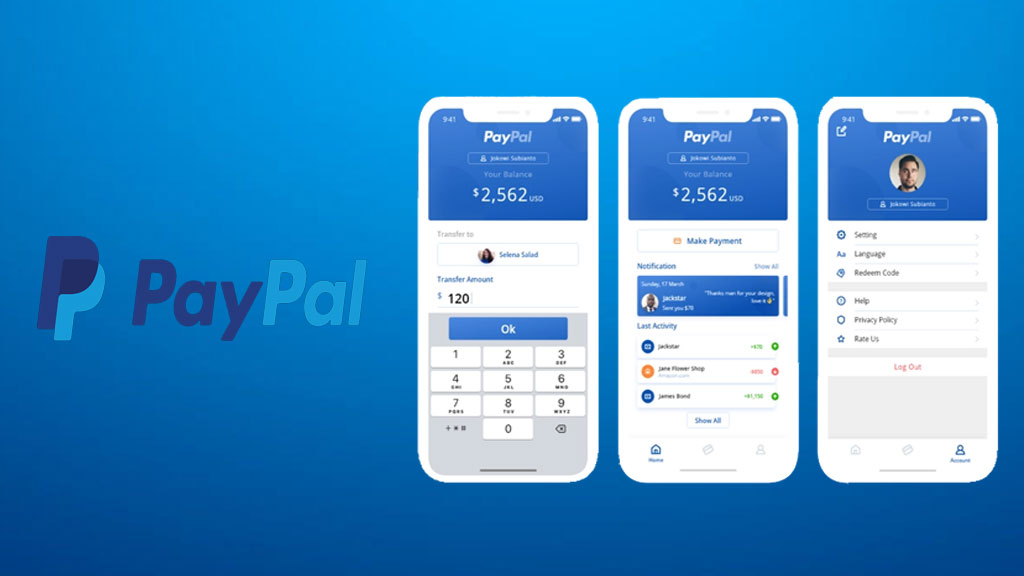

The loan Guidelines Equipment that provide customers that have an entertaining online, step-by-step help guide to identifying new head loan products that may match its providers requires and also to understanding the app process.

The web Application for the loan, an entertaining, directed software which is paperless and will be offering of use possess also an digital signature solution, the capability to mount supporting files for example taxation statements, complete an equilibrium layer, and construct a farm functioning bundle.

FSA likewise has a life threatening effort underway to help you improve and you can automate the Ranch Financing System customers-against organization process

An internet lead financing repayment feature you to definitely relieves consumers in the necessity of getting in touch with, mailing, otherwise seeing an area USDA Service Heart to invest that loan fees.

Network lovers will offer ranch loan rules studies towards the area-oriented teams therefore the groups can perhaps work alongside FSA to help producers see financing offered because of FSA, making certain that after they visit an enthusiastic FSA office, the fresh new lover providers user and FSA staff is also top let

USDA encourages providers to reach out over its regional FSA farm loan staff to be certain it grasp the quantity of loan and also make and you will maintenance solutions to aid which have carrying out, increasing, otherwise maintaining their agricultural operation. To help you do business which have FSA, suppliers is always to get in touch with their regional USDA Provider Heart.

MOST COMMENTED

Tin Tức

Dragon Spin Slot machine game Gamble 100 percent free Bally Ports 2024

Tin Tức

Leprechaun’s Chance Dollars Collect 100 percent free Enjoy within the Demo Function

Tin Tức

Verbunden Spielautomaten Traktandum Echtgeld Slots & Casinos 2024

Tin Tức

Emperor of the Water Harbors Enjoy Online for free Instantaneously

Tin Tức

Play Dazzle Myself 100 percent free Zero Free download Trial Position

Tin Tức

Marilyn Monroe ihre größten Filme

Tin Tức

Far-eastern Inspired Slots Enjoy 100 percent free and Real cash On the internet