Enabling customers as you go its economic requires is perhaps all we manage, for this reason the audience is equipping you with the pro opinion, info, and you will suggestions to help you get truth be told there.

- Financial Issues

- Property Choices

- Lifetime & Household

- Refinance Choice

- APM Insider

6 Most frequently Questioned Questions relating to Virtual assistant Funds

For individuals who or someone you care about features supported the country and you may are in reality looking to purchase a house, you can even wonder for many who be eligible for an excellent Va mortgage.

Virtual assistant mortgages give a lot of masters, such as no downpayment conditions, no individual home loan insurance policies (PMI) payment per month, and versatile underwriting recommendations.

Listed here are more aren’t asked questions regarding Virtual assistant fund. However, first let us identify who qualifies getting good Virtual assistant financing. You might obtain good Va financing when you are an energetic-obligation service associate, experienced, or surviving lover regarding a seasoned. Including veterans with service-linked handicaps.

People who be considered can get a certification from Qualification (COE) because evidence they are eligible for a beneficial Va mortgage. Unless you features a copy of your COE, the loan Coach will help you.

step 1. Were there Settlement costs On the a good Virtual assistant Mortgage?

Like with of a lot mortgage software, Va funds do incorporate a number of the standard settlement costs and charge. They have been charge you’ll pick of all money, in addition to for the appraisal, name lookup, title insurance, tape percentage, and other bank costs.

One commission which is specific to Virtual assistant fund is the Va money payment. You have to pay this-date payment right to the fresh Virtual assistant to save the loan system heading. How big is the fresh new Va capital fee relies on a few points.

To own first-go out have fun with, the brand new financial support commission is 2.125% of one’s overall amount borrowed. The latest financial support fee increases to 3.3% to have individuals who have previously used the newest Virtual assistant loan system, however it is going to be smaller because of the getting money off. Veterans who will be more 10% handicapped could be exempt out of this payment.

There are many methods end make payment on Va financial support payment out of pocket. You can negotiate to get the vendor shell out it fee, or you can roll the brand new resource percentage to your financial and financing it over the longevity of the loan.

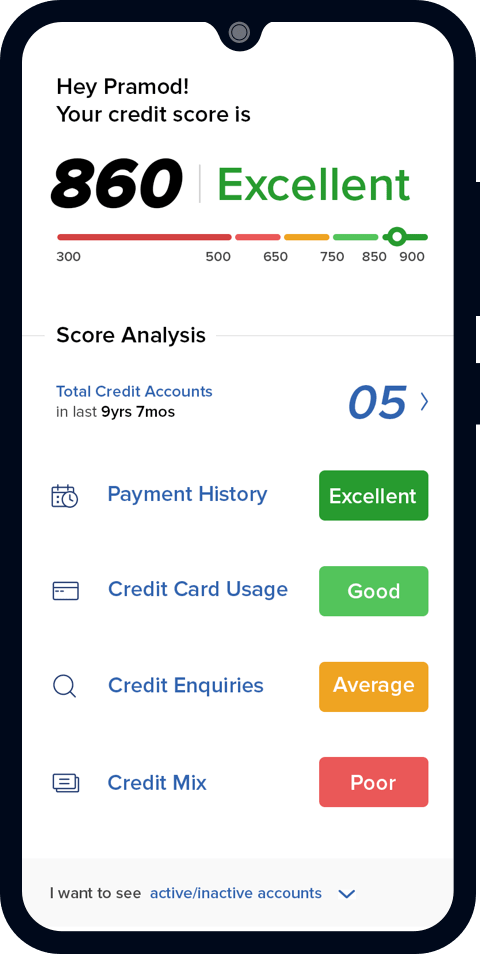

2. Exactly what Credit rating Would I wanted for good Va Mortgage?

Credit history requirements are one of the biggest fears for the majority homeowners, but they are you able for many great news? There is absolutely no credit rating need for Virtual assistant fund.

Just like the fun since this is, remember that even though the Virtual assistant loan program will not place the absolute minimum credit history, personal loan providers manage. Within APM, all of our minimum FICO get specifications try 580 having Va loans, which provides individuals more leniency. Yet not, it is essential to keep in mind that not absolutely all loan providers have a similar criteria.

You need to remember that the greater the rating, the better your payday loans Wadley own interest rate and you may loan conditions might possibly be. To know where you stand, you might obtain your totally free credit report one time per year out-of each of the three credit bureaus-or you can apply at an APM Mortgage Mentor by pressing right here to set up a totally free pre-qualification.

If you discover that you’ll require let enhancing your credit score, our knowledgeable APM Loan Advisors will always be right here to greatly help. We have been prepared to sit back to you to go over your financial disease and exactly how you could improve your FICO rating before applying having a good Va loan.

3. How frequently Do i need to Explore My personal Virtual assistant Home loan Work with?

As many times as you wish. There’s no restriction about many Virtual assistant funds you could potentially simply take call at lifetime.

MOST COMMENTED

Tin Tức

Gokhal Winner Bestaan Gokhal Winne eentje vermoedelijk gokhuis?

Tin Tức

Slot Galline

how much is a cash advance from advance america

Cut typically $step three,000 having Residential property to possess Heroes

Tin Tức

Best Boku Salle de jeu List of Salle de jeu that Accept Boku Updated 2021

Tin Tức

Opportune vers Msg Salle de jeu Deposit Hollande

best countries for a mail order bride

What i like would be the fact slip which you exhibited, in which more individuals is in public areas identifying

mail order bride websites reviews

Electronic designers exactly who clamor to access galleries is missing “the effectiveness of exactly what digital art will do