Benefit from the home’s value with home collateral finance into the Connecticut. Whether you’re trying remodel or money a major expense, experiencing their residence’s security can provide the fresh new monetary independence you you desire. Having aggressive household guarantee loan prices inside the CT and flexible terminology, lenders eg Griffin Resource create being able to access the home’s worth simple and easy simpler.

A house http://paydayloanalabama.com/margaret/ guarantee mortgage (HELOAN) was the second mortgage which enables present people so you’re able to use money against the equity obtained manufactured in their residence. With this particular type of mortgage, you have access to a lump sum payment of cash initial, which will be useful high otherwise unforeseen costs.

Fundamentally, the quantity you can acquire having a good Connecticut home equity mortgage is dependant on the fresh equity you have got of your house. Lenders will get allows you to obtain as much as a specific commission, generally 80%, of your home’s really worth without any the mortgage balance. Such as, if the residence is appraised at $eight hundred,000, while owe $100,000 in your mortgage, you may be able to borrow secured on $240,000 (0.80 x[$400,000 $100,000]) = $240,000. In many cases, you might maximum away equity as much as 95% of the value of the home.

Home security financing rates during the Connecticut is actually repaired, which means that your monthly premiums will continue to be a comparable throughout the lives of your financing, and that usually range regarding five so you’re able to 40 years. Some lenders may also render options for appeal-merely repayments or balloon repayments.

The good thing about house guarantee loans is they can also be be taken for anything. You can use the borrowed money to invest in resource properties, pay-off costs, if you don’t pick a secondary home.

Kind of House Security Fund

- Household security money (HELOANS): As stated, a fixed-rates household collateral financing enables you to sign up for a lump sum upfront. Such money feature repaired interest rates and you will monthly payments more a lay identity. Your own rate of interest will stay constant throughout the installment several months, guaranteeing predictability for the monthly installments.

- Family equity personal line of credit (HELOCs): A property security personal line of credit is another style of next real estate loan. It is exactly like credit cards in this it has an effective revolving credit line that allows you to draw money as the requisite. In place of HELOANs, HELOCs normally incorporate changeable rates of interest. These finance are available with a suck period that lasts numerous age and you will a payment months, if outstanding harmony have to be paid down.

- Cash-aside re-finance: A cash-away refinance changes much of your home loan which have the one that keeps a beneficial large principal balance. The difference between both of these number ‘s the bucks you utilize just like the loan. Which have a profit-away re-finance, you get the cash as the a lump sum, similar to a beneficial HELOAN. not, rather than good HELOAN, it’s not necessary to care about and work out a moment mortgage payment each month.

Great things about Connecticut Household Guarantee Funds

- Financial self-reliance: Family security financing promote homeowners the flexibleness to get into a giant sum of money to follow individuals financial needs instead restrictions into the primary residential property, second homes, and funding attributes.

- Competitive cost: Family guarantee money during the Connecticut feature aggressive rates, leading them to an attractive borrowing from the bank option versus other forms regarding borrowing.

- Secure money: Which have fixed rates of interest, family guarantee loans provide individuals which have secure monthly premiums, enabling much easier budgeting and you may financial believed.

- Prospective income tax masters: You’ll be able to qualify for income tax write-offs when your domestic guarantee loan is employed to possess home improvements.

- Enhanced value of: And prospective income tax positives, using your home equity financing to own renovations and you will upgrades is also increase your worth of, therefore it is value so much more when you decide to sell.

- Higher borrowing from the bank restrictions: Domestic security loans support high credit restrictions than the unsecured money, thus people can access a larger degrees of capital to have big plans otherwise costs.

Home Security Financing Requirements

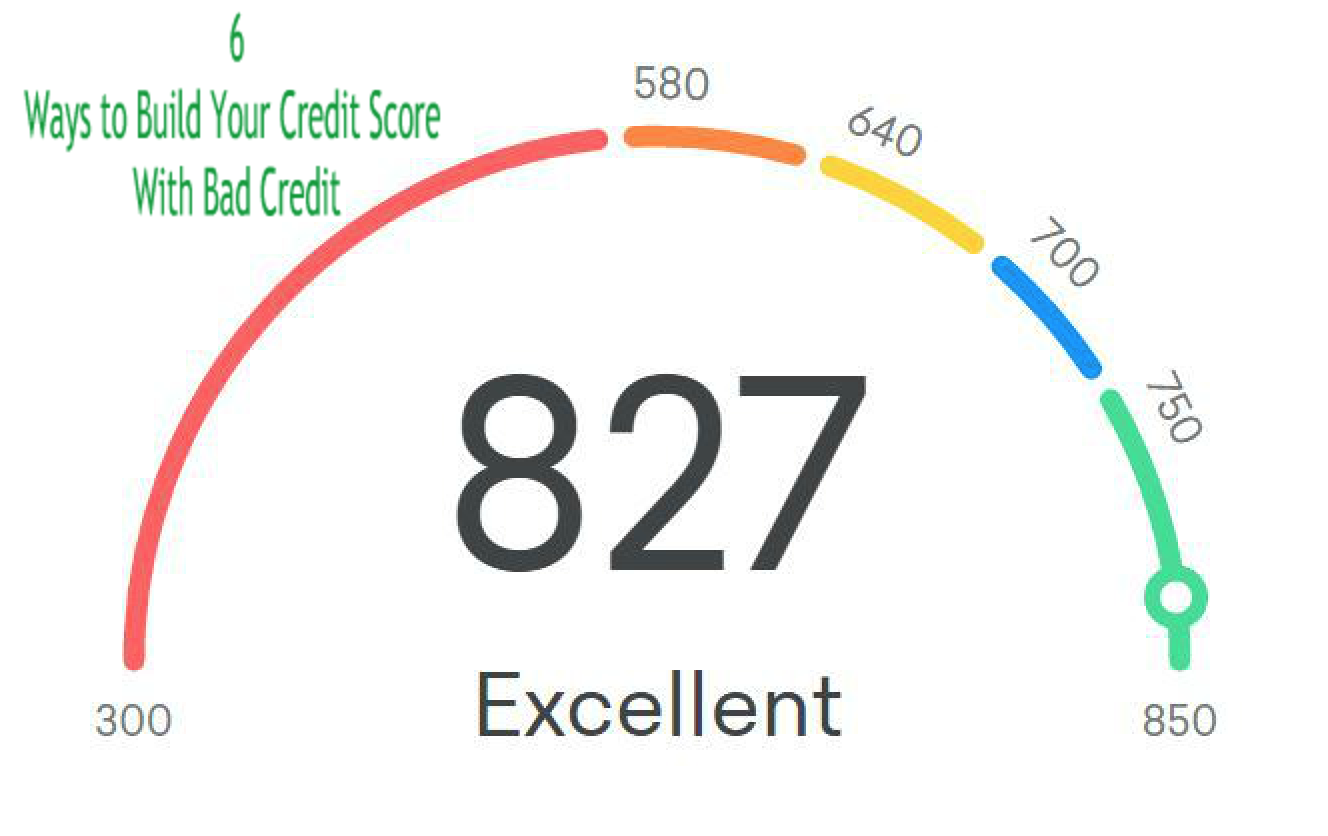

Knowing the qualification standards is essential as you talk about the possibility out-of house guarantee finance. Multiple key factors, off creditworthiness in order to property evaluation, determine their eligibility for those fund.

Apply for property Guarantee Financing when you look at the CT

Applying for a house equity mortgage during the CT is a straightforward procedure that enables you to utilize the property value your property to own various financial demands. With aggressive cost, versatile terms and conditions, and you may individualized services, Griffin Capital helps make opening their house’s collateral easy.

Shortly after you will be prepared to initiate the applying techniques , you could potentially reach out to Griffin Capital to go over your specific financial specifications and you may mention the new available financing choices. We of educated benefits will show you from processes to make top choice.

Need help examining your financial situation to choose if the property security financing when you look at the Connecticut suits you? Obtain brand new Griffin Silver app to understand more about the financial selection and take control of your cash.

MOST COMMENTED

Tin Tức

State-of-the-art Hockey Analytics

Tin Tức

Weapons Letter Roses Position Review Demo & Free Play RTP Take a look at

Tin Tức

Higher The liver Nutrients in the Animals: A vet Demonstrates to you What it Form Dr Buzby’s ToeGrips for Dogs

Tin Tức

Possibility the brand new Wind gusts of Luck Dominick Trilogy, 2: McBain, Laurie: 9781492631088: Amazon com: Guides

Tin Tức

Exactly what are the Best Gambling enterprise 150 opportunity 7 monkeys Websites for us Professionals? Partagez vos moments forts

Tin Tức

a hundred Happy Chilies Slot Demo and you may Remark Spinomenal

Tin Tức

$1 Deposit Casinos Canada 2024 To 150 Totally free Spins to own $1