Financial refinance cost during the 2024 possess leaped in order to 20-season highs. There are still specific home owners available that may must refinance in advance of mortgage pricing increase after that.

Even after large interest rates, you still can help to save cash on charge and you will settlement costs whenever you are doing your own mortgage re-finance. This may wind up saving you quite a bit one another up top as well as over time.

step one. Store Lenders!

A good thing that can be done to reduce your own fees and you will settlement costs are to contrast the latest costs you to definitely individuals lenders charge. There are many costs that are nonnegotiable, but numerous are usually.

A number of the fees that you may possibly get a hold of specific variance with the include the questionnaire payment, label browse commission and pest inspection percentage, if applicable. Make certain you score a detailed summary of their fees and you may closing costs of for every lender to its contrast apples in order to apples.

Together with, envision asking their bank to fit the low settlement costs that you discovered in other places. So it bank possess a lowered price however, charges large fees. Some home mortgage refinance loan loan providers from the ascending rate of interest sector require their refinance providers that will budge on new closing costs than you may imagine.

dos. Negotiate Refinance Fees

Once you’ve a beneficial comprehension of all the charge this new lender desires ask you for, you could start brand new negotiation techniques. You should request some of the far more rare charges so you can be taken off of the finally bill of the financial refinance.

In addition is query the loan bank so you’re able to waive the price tag to the app while the processing commission. The application commission covers brand new lender’s administrative prices for your implementing toward financing.

Loan providers might not want to get rid of its origination payment. But if you know what the common rates for that try, it assists your as you buy home financing. A familiar origination payment is step one% of loan amount. New origination percentage getting a great $three hundred,000 refinance is around $3,000. While you are working with a lender which charges more than one, you might ask them to get rid of they. The greatest you can be billed for a keen origination fee is 2%, however, we could possibly without a doubt comparison shop when your financial wants to charge a fee for example a high percentage.

This new re-finance financial is to supply the closure revelation function just like the in early stages once the possiblepare everything you select into closing revelation as to what the truth is for the home loan guess. Inquire the lender to explain whatever is not necessarily the exact same.

Your lender you are going to thought waiving otherwise cutting specific charges, having software, origination, and you will underwriting charges becoming eg a beneficial components to help you start discussions.

step 3. Waive Appraisal

Whether your domestic might have been appraised anytime has just, you will be in a position to skip the new appraisal. Ask the lending company if you possibly could score an assessment waiver. If you are not capable waive it entirely, you may be able to help save some bucks by getting a keen automated assessment as opposed to an entire one having a real peoples getting. See if youre eligible for a mortgage re-finance with zero assessment needed.

cuatro. Save very well Term Insurance rates

You might ask for a great reissue price in your title insurance coverage once you re-upon they to own a home loan refinance.

When possible, security prepaid items in progress. At least, think expenses your own home insurance and you may property income tax reserves really. Just after closing, your bank will point a look for a comparable count.

Loan providers maintain an enthusiastic escrow be the cause of essential expenses however, reimburse the brand new surplus after you refinance or fully pay back the mortgage. Since this is a relatively quick-name bucks expenses, this is not advisable to utilize they into the the fresh new mortgage equilibrium and you can stretch the fresh new commission more ten years.

Every the fresh new financial keeps charge and you can closing costs. You can choose for a no closure cost mortgage with a few lenders. But remember that it really means you are purchasing closing costs and you can fees because of the a separate mode. You have got the option of running settlement costs into your mortgage re-finance. Otherwise, you could have free’ closing costs that are included with a high interest. If you should do you to definitely relies on a couple of things.

To start with, you need to know if you want to remain in this new domestic consistently or not. If you intend to remain in the house for over 5 years, you might want to just bite this new round and you can pay the closing costs now. A potential exemption is when you want to repay higher interest personal debt that have cash arises from the newest re-finance. When it makes reference to you, repaying that obligations will be smarter than just paying the closing costs up front. There are a few loan providers offering refinance mortgage loans no closing costs, so discuss with.

Into the no-closing-prices refinancing, the fresh new debtor will not generate initial money of these costs but alternatively address all of them through the years. This is achieved due to one of two methods: sometimes new settlement costs try a part of the newest mortgage, and therefore raising the harmony, otherwise a higher interest rate is selected. Several lenders promote choices for no-closing-cost refinances.

6. Features A history on the Lender

Particular experts recommend shopping around with many different mortgage refinance lenders, and now we are unable to argue with this. many loan providers can charge your smaller when it comes to charge and you can settlement costs when you have signed home financing with them prior to. At least, there is certainly shorter files on it when you are a reputable client.

seven. Have more Offers

Certain loan providers get reduce your closing costs if you have alot more property regarding lender. Lenders like Bank away from The usa could possibly get treat origination charges on certain loans if the borrower has actually more cash inside offers.

If you consider refinancing your residence, you could potentially possibly save your self large to the lending fees and you will www.paydayloanalabama.com/locust-fork closing costs into the a lot more than guidance.

MOST COMMENTED

find payday loan no credit check

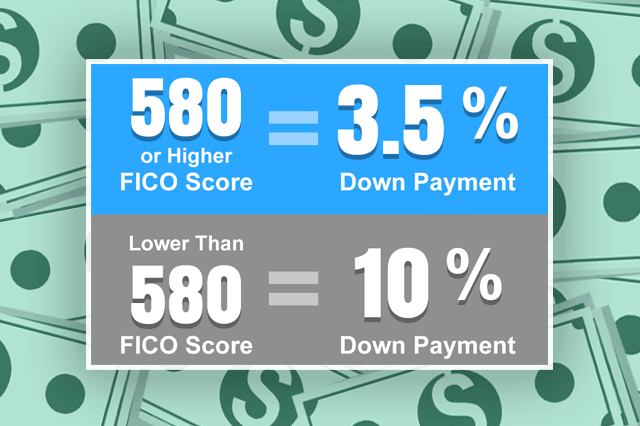

Into the application for the loan procedure, plenty of things is considered, together with your credit and you can financial history

Tin Tức

Monster Precision: Five 10 Dragon Climbing Footwear Opinion

Tin Tức

5 Minimum Deposit Gambling enterprises Lowest Minimum Deposits for 2024

payday loan no credit check low interest

How can Domestic Collateral Funds Operate in Connecticut?

Tin Tức

£5 dragons pearl $1 put deposit instead of GamStop Put & Get extra ACHS College or university

getting a cash advance

six Questions Mortgage lenders Find out about Your earnings

no credit check direct deposit payday loans

Appointment new Conditions with no-Appraisal Family Equity Finance