Such, you could potentially spend some point to lessen your rates and something suggest the financial institution/broker to fund its percentage. Altogether, you would shell out a couple of things, but also for one or two various other grounds.

Is Origination Costs Simply Nonsense Costs?

- Financing origination fees commonly always thus-named nonsense fees

- He or she is income paid to have assisting you to obtain a loan

- And simply because you are not energized the price physically doesn’t mean it will be the finest contract

- Go through the large visualize (APR) to select the greatest promote

The loan origination payment isnt always a junk percentage watching many mortgage originators do not get paid back salaries, since listed. So they really need to get paid down somehow.

However, whenever they usually do not charge a fee really, it really function they’ve been earning money a unique way, possibly thru a higher rate of interest and you will/or by the asking most other lender costs.

Specific mortgage lenders is also earn a support release premium (SRP) following the loan shuts because of the selling it in order to an investor to your the latest secondary business.

Therefore do not get turned-on about any of it, simply try to discuss will cost you down just like the greatest you could potentially. Otherwise wade someplace else for your loan if you aren’t amazed.

How come its either offered junk payment condition is the fact it’s have a tendency to a fixed payment, and thus it is not necessarily tailored with the particular financing or enough time/risk in it.

Such, why should a financial charge the same 1% percentage into https://paydayloanalabama.com/trussville/ one another good $200,000 amount borrowed and you can a great $700,000 amount borrowed whether your job is basically the exact same?

This should imply all of our first debtor carry out simply be recharged $dos,000 to own a mortgage, while the next borrower would be energized an astounding $seven,000, that’s almost 4x the fresh fee.

In the event that this type of fees was based on a money amount rather, skeptics may not thought them nonsense. Otherwise may think these are typically shorter junky.

Another type of group of fintech lenders are often waiving the fresh origination commission and you can/or otherwise not charging you they in the first place, that could signal the ultimate dying.

Deteriorating the mortgage Origination Payment

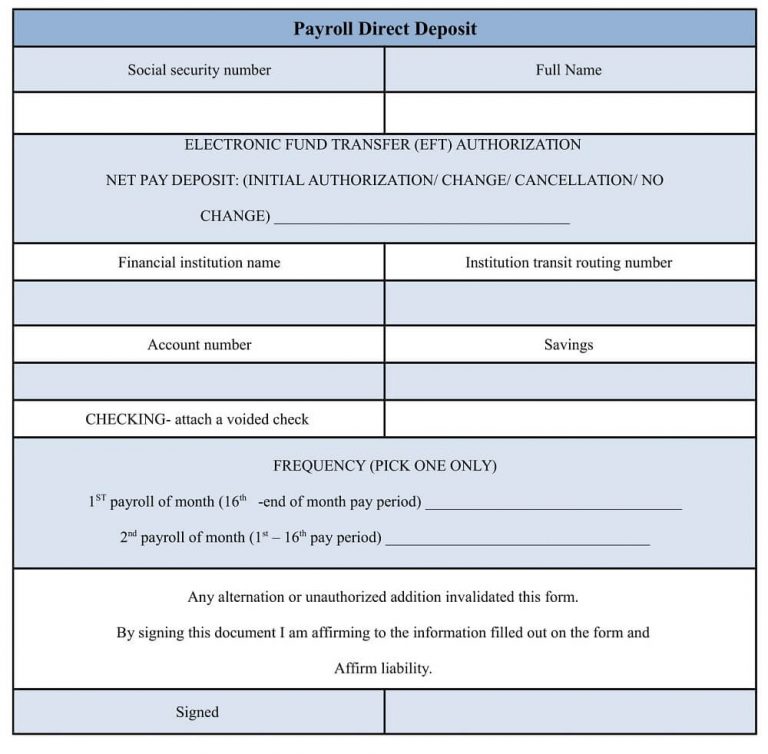

It is a beneficial screenshot from a real Good-faith Estimate (since replaced from the Loan Imagine), and that displays the brand new adjusted origination costs.

On the example significantly more than, the loan origination charge are $1,840 towards the an excellent $348,000 amount borrowed, that produces the cost around half of a share part (.50%).

This representative charged a great $250 origination fees, a $695 control commission, and an $895 underwriting payment, which combined make up this new $step 1,840 total.

Note that these types of costs are represented as a whole lump sum payment on the the great Trust Imagine, thus request a dysfunction to see what you’re in fact are energized. Or refer to the Charges Worksheet.

The fresh new corresponding Costs Worksheet envisioned more than stops working the fresh origination charge so you can ideal know what you’re getting billed and exactly why.

Yet not envisioned here, lenders generally speaking screen a share on the same line because the Mortgage Origination Commission, like step one.000%, if applicable. This will give you a much better idea as to what you might be in fact getting energized.

Today let us reference the big screenshot again. The debtor including obtained a loan provider credit off $3,, and therefore offset the entire origination charges and, ultimately causing an adjusted origination costs regarding -$step 1,.

Towards brand new Financing Estimate (LE) otherwise Closing Revelation (CD) models, you will notice this post on the webpage 2 from often mode around brand new area called Loan Can cost you.

Here you will find the new Origination Charges, which could are a predetermined fee and you will/or a portion of your loan amount depicted from inside the factors.

Inside example, brand new borrower try energized an eighth (0.125%) of your own amount borrowed in the form of discount situations and you may a management fee out-of $step one,495.

MOST COMMENTED

Tin Tức

Instrument A Avec Aristocrat : Amuser Pour Avec Multiples Gaming Gratuitement

Tin Tức

Galet Gratuite Gaming pour galet gratuite sans avoir í téléchargement

Tin Tức

10 jeu de empocher pour largent un tantinet gratuitement ou tout de suite

Tin Tức

Hasard un brin Brique Réel, Pourrez aux différents Plus redoutables Salle de jeu

payday advance loans no credit check

When Can i Thought a homeowner Financing

Tin Tức

Instrument pour thunes Caesars : Distraire í tous les machine a avec sans aucun frais 100 000 ballades gratuites

Tin Tức

Machine abusives, gaming en compagnie de salle de jeu un peu mode démo